Navigate the Adolor ADLR Research Pages

- Introduction (valuation, financials, company outlook)

- Entereg (marketed hospital product used to accelerate GI function after bowel surgery)

- ADL5945 (phase 2 product candidate for opioid-induced constipation)

- Pipeline (details on earlier stage assets

2012 Cubist Updates

Cubist is now selling the product with their hospital sales force. 2012 sales guidance is $40-45m, up from $32m in calendar year 2011.

Notes from 2q2012 Cubist conference call re Entereg.

Notes from 2q2012 Cubist conference call re Entereg.

Entereg (a.k.a. alvimopan): marketed product in US

- Mu opiod receptor antagonist approved by the FDA for indication of "post-operative ileus" in May 2008

- "Indicated to accelerate the time to upper and lower gastrointestinal (GI) recovery following partial large or small bowel resection surgery with primary anastomosis." There are 500,000 such procedures per year in the U.S by 4000 hopstials- 1600 of which perform 80% of the surgeries (2010 10k)

- Approved with REMS restrictions due to CV risks associated with long-term dosing (phase 3 long-term safety study for OBD showed numerically more heart attacks in April 2007): no more than one dose prior to surgery and 14 doses following surgery are permitted.

- 2010 10k: FDA recently completed post-marketing drug safety evaluation (PDSE) and made no changes to label- looked at GI perforation (hard to attribute as related or not to Entereg use) and MI (all had some other underlying conditions)

- Data shows that Entereg shortens hospital stays by about a day on average- representing significant cost savings to hospitals and freeing up the bed space sooner. The cost is in the range of $700 per patient (this was a federal VA price and is somewhat outdated figure)

- Since approval, numerous groups have conducted comparative outcome studies to evaluate whether these patient, hospital, or cost benefits are actually realized. The data for one retrospective cohort study clinical trial of 7000 patients is at this link. Summary: the data are quite compelling- patients receiving Entereg had statistically improved rates of each of the following-

- Death (0.4% vs 1.0%)

- In-hospital GI morbidity (30% vs 36%)

- In-hospital CV morbidity (19% vs 24%)

- In-hospital pulmonary morbidity (7.3% vs 10.5%)

- In-hospital infection morbidity (9.2% vs 11.5%)

- In-hospital thromboembolic morbidity (1.2% vs 2.1%)

- Re-admittance within 15 days of discharge (7.4% vs 8.7%)

- Length of ICU stay (0.3 vs 0.6 days)

- Length of hospital stay (5.3 vs 6.4 days)

- The above results (reported August 2010) are really impressive and should generate significant healthcare cost savings and patient benefits- but I can't find that ADLR has publicized or promoted these results in any way. EDIT 2/2011: company announced manuscript submitted and upcoming conference presentation. 3/2011: data further discussed at Cowen conference- calculated mean $2345 hospital cost savings per patient on Entereg. The publication of one smaller, prospective study was announced via this press release.

- 5/2011: three studies on Entereg use were presented at the ASCRS meeting - click here for details. These studies supported the ability of Entereg to reduce pt morbidity and mortality, reduced length of hospital stay, and reduce hospital expense

- A phase 4 post-approval trial was required and initiated in 2009 for patients undergoing radial cystectomy for bladder cancer (NCT00708201). 2010 10k: enrollment of 300 pts will be complete late 2011. Two pediatric phase 4 trials are planned, the first will begin in 2013

- Reductions in the number of bowel resection surgeries or the use of opioids would decrease the market size for Entereg. 3/2011: but contrary to popular belief, 270+M opioid rx were written in 2009 and market has still be growing in size.

- 5 yr new chemical entity (NCE) Hatch-Waxman exclusivity expires 5/20/2013, Use patent expires 2020. First COM patent expires 3/29/11 but expect extension to 3/29/2016. Second COM patent expires 2013.

- Generic ANDA could be filed 5/2012 with paragraph IV certification or 5/2013 without.

Entereg - Financial details

- Partnered with GSK for $50 million upfront, and ADLR co-promotes with 25 of its own salespeople in certain markets. ADLR received 45% of profits (calculated as net product sales minus certain costs). This amount will increase to 50% starting 7/1/2011. Term of deal runs 10 years frun first sale so expires 6/2018.

- Owe a total of a single digit royalty to Shire and LLY until the LLY patents runs out (total of $2m in 2010 up from $1.2m in 2009). 6/2011 CC this was disclosed to be about 8% and will end in 2016. No royalties owed related to the 2020 use patent as this was developed internally.

- Note this is an odd case where the sales are reported by the smaller partner ADLR and not by GSK- so for example the $7.5m sales reported in 1q2011 is not what ADLR keeps, they have to pay GSK out of that (55% plus agreed on SG&A costs). 2010 10K stated that ADLR paid $7.9m profit share to GSK in 2010, up from $2.1m in 2009)

- Cost of product sales for 2010 (COGS) was 11% (includes royalty payments, FDA fees, manufacturing costs. As of 3/31/11 there is still inventory generated prior to approval that has a Zero cost of goods- so the COGS percent of sales will increase

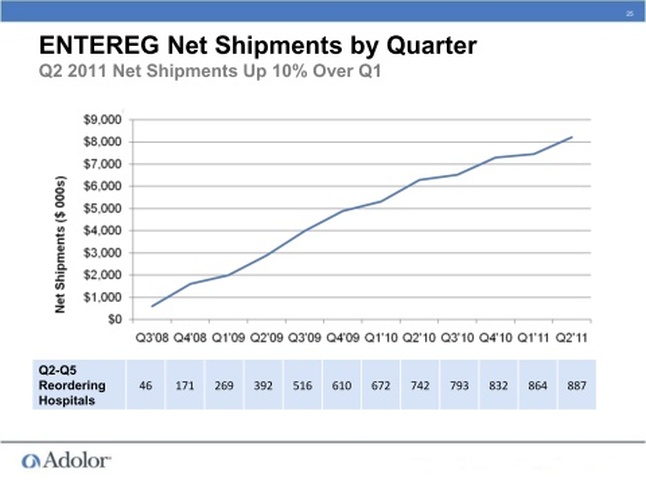

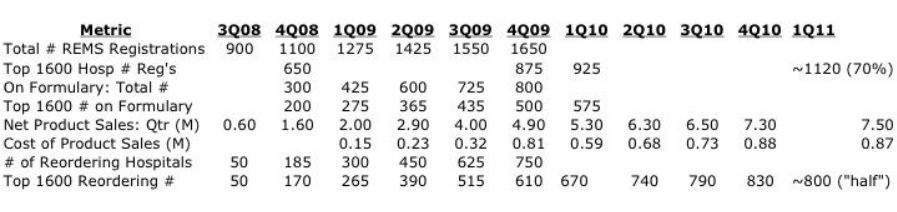

- For the first few quarters, ADLR released a host of sales metrics (including REMS registrations, formulary acceptances), but this practice has largely stopped unfortunately. However, at 3/7/11 Cowen presentation (and 4/28/11 1q2011 CC), they did provide a figure showing sales growth and the number of 1600 critical hospitals (perform 80% of bowel resections) registered for REMS program was >1100 [70%] and # reordering Entereg was ~800 [50%]- see below

- 2/2011: Entereg is currently at $30m run rate which is about break-even. [so cost of goods, marketing etc, ADLR sales force, and 55% share to GSK = $30m] No 2011 guidance but expect continued market share growth. 3/2011: sales growth continues and expect to continue in future. 4/28/11: Most of the sales efforts now focus on increasing sales at exisitng prescribing hospitals, with some effort to get new hospitals registered

- 4/2011: Entereg sales increased 42% from 1q2010 to 1q2011, this represents a 20-25% increase in demand combined with two price increases [taken based on product performance and health economic benefit publications]. However, Entereg volume declined from 4q2010 to 1q2011 and mgmt offered only feeble excuses for this.

- Sales growth has been slower than hoped, leading to some fear that GSK might return rights to ADLR. GSK has previously abandoned interest in the drug for opiod-induced bowel dysfunction and has no interest in pursuing Entereg development in Europe (this is due to several factors, including a failed clinical trial, differing clinical practices- less opiod use, hospital discharge less based upon GI function compared to US). 3/2011: asked about GSK commitment at Cowen conference, and CEO didn't instill a great deal of confidence-he merely said that they are the partner right now and are until they say otherwise...and offered comments that ADLR could handle a transition, aided by the fact that they already managed the NDA and REMS.

- This issue and these comments have come to the forefront...in June 2011 ADLR announced that they had reacquired all rights to Entereg from GSK - Click here for PR - Click here for blog post with my notes from CC.

- Pay GSK $25m cash spread over a 6 year period ($2.5m in 2011, no more than ~$4m in any year)

- Pay GSK tiered mid-single digit royalties on net sales as long as ADLR sells the product

- Could pay one-time sales based milestone of $15m to GSK... "structured to be out there a few years"

- Double Entereg-related sales/marketing team from ~30 employees to ~60 employees as product transitions from GSK by 9/1/2011 in order to cover vast majority of existing customers. ADLR has always played significant leadership role: ran NDA, REMS, manufacturing, medical affairs. So the primary change after this transaction closes will be product detailing. Currently ADLR reps work alongside 150 GSK reps in large markets. These will remain in their current geographies. Also will add new account managers where only GSK reps were previously. Other new task: physical distribution and contractor relationships with government, GBO, etc. Plan to use an established 3rd-party distribution company

- From 2h2008 launch, heavy lifting in terms of REMS and formulary registration have already been done

- Goal is to enter 2012 at $40m sales run rate. Threshold to breakeven on the drug is now lower than $30m. Breakeven for entire company is now sales level in low $40m's...but this doesn't count cost of phase 3 trial for OIC program...

- Company expects that drug will contribute meaningful cash flows. "In 2012, expect product contribution of 30% of sales. could grow to 50% in future years" [I am not sure exactly what calculation they are making in terms of accounting, but they seem to be saying that Entereg efforts will be profitable for the year, whereas previously it had been losing money and only recently approached break-even]

- "This deal is immediately cash flow accreitive compared to current joint venture (JV) structure with GSK"

- This transaction opens new commercial opportunites to "leverage sales force" - specifically mentioned their potential future OIC drug [but this is a long time from entering the market] or opportunity to promote other current hosptial products...this is a little scary to me as rationale for doing this. I am not in the camp that is supportive of companies trying to become commercial enterprises after many years focused on R&D, this rarely works out well IMO.

- ADLR will now have less geographic reach but better productivity with Entereg