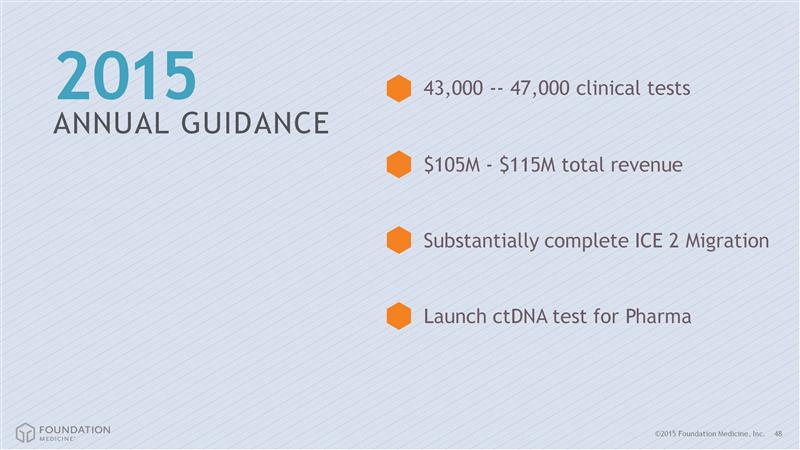

In trading today, Foundation Medicine $FMI stock has completed a remarkable roundtrip, giving up all the gains from a spectacular move from sub-$20 to over $50 on the back of their splashy deal with Roche announced at the JP Morgan Healthcare Conference. While the stock has been dribbling downward for months, the last ten bucks comes as a result of their second quarter earnings release and conference call held on July 29, 2015 where the company slashed its 2015 guidance for FoundationOne test numbers and revenue.

So why the change in guidance? We'll let management explain, courtesy of the ThomsonReuters transcript published on Yahoo:

"The payer process in the US is complex, and a lack of clarity at the local MAC level does nothing to simplify the route to coverage. We are being much more proactive at the state and federal levels to bring awareness to this process. And we are working to not only ensure coverage for patients, but to implement change to the system. While we continue to push on all fronts we are no longer assuming any Medicare payment for the rest of 2015. That said, we do expect additional progress at the regional level, and Jason will provide additional commentary. Given what I have just stated, we are updating our outlook for clinical testing volume to 35,000 to 38,000 clinical cases, and revising 2015 full year revenue guidance to a range of $85 million to $95 million....

We had planned as Mike mentioned for a portion of our Medicare cases to be paid starting in the first half of the year, and the lack of an LCD in our region, began to impact the growth curve of clinical revenue and testing volume. We believe that more consistent utilization in comprehensive genomic profiling will ultimately require a positive step by NGS."

Clearly, on June 24th, it would have been pretty clear that no Medicare revenue was coming in the first half. Can the company point to anything that happened between then and now to affect the likelihood of Medicare revenue later in 2015? It seems a stretch to claim that the business changed to any major extent in last few weeks since then, particularly given the recent positive newsflow such as the final coverage determination from Palmetto on July 6 and other regional payor progress announced recently.

First half 2015: $41.8 m total revenue

Second half 2015 new guidance: $43.2-53.2 m (3-27% growth)

First half 2015 clinical volume: ~16,700 tests

Second half 2015 new guidance: ~18,300-21,300 (10-28% growth)

This is not the growth trajectory investors were looking for. Lost in the shuffle of the Roche announcement was the pretty poor performance in 4q-2014 that was announced concurrently.Thank goodness for the cash infusion from Roche, or FMI would have been running on fumes. Hopefully they can right ship commercially before the cash burn eats through their funds.

Whatever goodwill management earned with the rich Roche deal, they gave it away with their handling of this drastic cut in guidance. This company clearly has the splashy graphics and touching case vignettes down pat- now it is time for a bit of accountability on the dollars and cents side of the business.

RSS Feed

RSS Feed