Navigate the Antares Pharma $ATRS stock research pages

Introduction: financials, highlights, pipeline, upcoming events and catalysts

Injectables: Vibex, HgH, Teva collaborations, Pen injectors, autoinjectors, MTX program

Vibex injectors: Includes epi-pen and undisclosed drug partnered with Teva

Vibex MTX and QST: Internal programs for injectable methotrexate and testosterone

Pen Injectors: Two undisclosed programs partnered with Teva

Gels: Transdermal technology, Elestrin, Nestragel, Libigel with BPAX

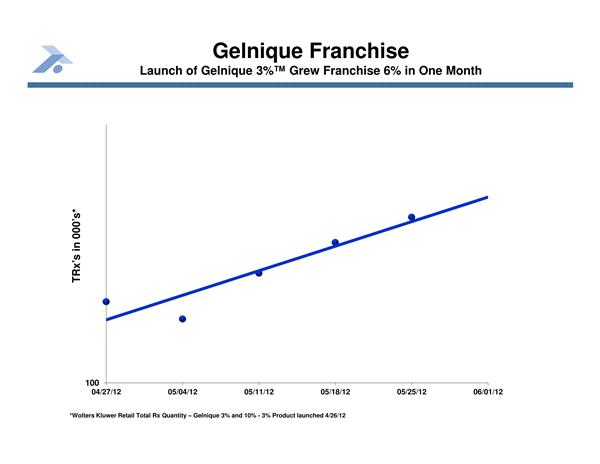

Anturol/Gelnique 3%: FDA-approved Overactive bladder gel licensed to Watson Pharma

Blog: Archive of all posts related to AIS/ATRS

Injectables: Vibex, HgH, Teva collaborations, Pen injectors, autoinjectors, MTX program

Vibex injectors: Includes epi-pen and undisclosed drug partnered with Teva

Vibex MTX and QST: Internal programs for injectable methotrexate and testosterone

Pen Injectors: Two undisclosed programs partnered with Teva

Gels: Transdermal technology, Elestrin, Nestragel, Libigel with BPAX

Anturol/Gelnique 3%: FDA-approved Overactive bladder gel licensed to Watson Pharma

Blog: Archive of all posts related to AIS/ATRS

Anturol (aka GELNIQUE 3%): a 2011 FDA approval

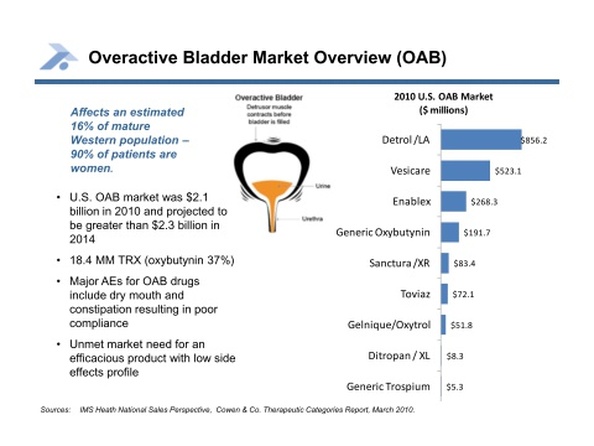

- Anturol is a oxybutynin gel product for the treatment of overactive bladder (OAB)- currently a $2.1 billion market (>18m prescriptions) and growing, representing 16% of mature Western population (90% of pts are women). 18.3m scripts per year, 34% of which are for oxybutynin products. This product would compete with the following products- also, TEVA has a vaginal ring oxybutynin in clinical development. The following is a summary of the OAB market competitors (Rx shares from 2010 10k report):

- Detrol LA (tolterodine tartrate): $984m annual sales (33% of Rx's) for Pfizer. Dry mouth in 23% of pts, constipation in 6%

- Vesicare (solifenacin succinate): $452m annual sales (17% of Rx's) for Astellas/GSK. Dry mouth in 28% of high dose pts, constipation in 13% of high dose pts

- Enablex (darifenicin): $245m annual sales (9% of Rx's) for Warner Chilcott. Dry mouth in 20-35% of pts, constipation in 15-21%

- Generic Oxybutynin: $197m annual sales (32% of Rx's, plus $13m for branded Ditropan). Dry mouth in 71% of pts, constipation in 15% of pts. 3/7/11 at Cowen- dry mouth quoted as 75% in standard form, 25% in extended release

- Sanctura (trospium chloride and XR): $85m annual sales for Allergan. Dry mouth in 11%, constipation in 9%

- Gelnique (oxybutynin chloride gel) and Oxytrol (oxybutynin patch): $51m annual sales- both sold by Watson Pharma. Dry mouth in 8%, application site reactions in 5.4%, constipation in 1.3% (Gelnique). Dry mouth in 10% of pts, application site reaction in 17% of pts. Patch is ~8x6cm (larger than I would have guessed, a bit smaller than a baseball card). 3/7/11 at Cowen Gelnique sales quoted as $25-30m. 11/2010 analyst conference: Gelnique does not offer a pump or choice of doses. Gelnique approved January 2009

- Toviaz (fesoterodine): $21m annual sales for Pfizer. Dry mouth in 35% of high dose pts, constipation in 6% of high dose pts

- Anturol's differentiation would be in reduced PK variability and application site reaction (vs patch); decreased side effects (common among anticholinergic drugs in this class), especially dry mouth [especially concerning given the indication of OAB] and constipation (vs oral versions); and the ability to titrate the dose via number of pumps dispensed (important to compete with newer oral drugs that offer multiple drugs)

- As of the end of 2010, AIS had spent $17.8m on the development program, including $4.9m in 2010. Additional $0.3m spent 1q2011 (so $18.1m total).

- The Anturol phase 3 clinical trial (click here for clinicaltrials.gov link ) was conducted under an SPA with the FDA initiated in 4q2007 and included about 60 sites. Randomized, double-blind trial with 3 arms with ~200 pts per arm (placebo, 56 mg anturol [2 pumps], 84 mg anturol [3 pumps] daily for 12 weeks). Primary endpoint was reduction in number of incontinence episodes at 12 weeks compared to baseline. about 10-15% of pts were men, average age late 50's, entirely in US. Dry mouth in 11-12% [4/5/11 at Needham- higher than current gel or patch because getting more drug into bloodsteam], constipation in 2.6% [similar to placebo], application site reactions in 4% of pts. 1% of pts discontinued due to dry mouth, 3% due to application site reaction. 4/5/11 at Needham- did not see dizziness or fatigue seen with some newer oral meds

- Successful results for primary endpoint were announced in July 2010- statistically signifcant improvement in reduction of incontinence episodes compared to placebo (p<0.05 for each dose). 3/7/11 at Cowen: Reduced urges within first week and sustain through 12 weeks. 4/5/11 at Needham- efficacy comparable to market leader among oral drugs

- A safety extension (3/14/11 4q10 CC: 77 pts at mutliple ctrs at the higher dose for 24 weeks. No clinically meaningful changes or observations; 4/5/11 at Needham- better completion and compliance than expected) was completed and the NDA was filed with the FDA in December 2010.

- In February 2011, AIS received a waiver of the 1.5m PDUFA fee (significant for a company with AIS's limited cash)- this did serve to delay the receipt of the official NDA acceptance- received 4/8/2011-click for press release)-PDUFA date is December 8, 2011

- 4/5/11 at Needham: Market research suggests that dr's switching pts to Anturol would be at the expense of the oral meds, not switching from current gel/patch. Anturol phase 3 data has been accepted for presentation at summer 2011 medical meeting

- 2010 10k update re manufacturing: "We have contracted with a commercial supplier of pharmaceutical chemicals to supply us with the active pharmaceutical ingredient of oxybutynin for clinical quantities of Anturol® in a manner that meets FDA requirements via reference to their DMF for oxybutynin. We have contracted with Patheon, Inc. (“Patheon”), a manufacturing development company, to supply clinical quantities of Anturol® gel in a manner that may meet FDA requirements. The FDA has not approved the manufacturing processes for Anturol® at Patheon at this time. We have completed commercial scale up activities associated with Anturol® manufacturing required for the NDA. We anticipate the FDA will perform a site visit of Patheon during 2011 in connection with the review of the Anturol® NDA.

- Partnering status: 3/7/11 at Cowen: AIS is in discussions with several potential partners (described as seeking mid-sized women's health pharmaceutical companies. Present market research suggesting 20% transdermal market share- but I am skeptical. 3/14/11 4q10 CC- now seeking optimal arrangement. Possible deal before approval. Will do a deal that valued the asset properly and gives AIS a say in the commercialization. 3/15/11 at Roth: several new potential partners have come forward after NDA filing, don't think they need approval before striking a deal. 5/9/11 CC: expect to conclude anturol partnering transaction, see interest from a number of potential partners "pleased with where we are in discussions and will leave it at that"...plan to partner before approval

- 7/2011: License agreement signed with Watson Pharma $WPI (PR) - no upfront payment, undisclosed milestones on FDA approval and future sales levels, undisclosed escalating royalties. WPI assumes some manufacturing start-up activities. [Quite simply, this seems to be an awful deal for AIS based on the lack of disclosure on any terms...possibly stemming from the patent issues - see link below]

- 2010 10k: We are aware of two related U.S. patents issued to Watson Pharmaceuticals relating to a gel formulation of oxybutynin (Gelnique®). We believe that we do not infringe these patents and that they should not have been granted. We may seek to invalidate these patents but there can be no assurance that we will prevail. If the patents are determined to be valid and if Anturol® is approved, we may be delayed in our marketing of Anturol® or incur significant expenses defending our patent position which may adversely affect the potential market value of Anturol®. (I need to look into this further)...Click here for 5/30/2011 blog post on this topic.

- Competitors: Mirabegron (Astellas), ONO-8359 (Ono Pharma) - Click here for summary of their data at AUA 5/2011.