Navigate the Antares Pharma $ATRS stock research pages

Introduction: financials, highlights, pipeline, upcoming events and catalysts

Injectables: Vibex, HgH, Teva collaborations, Pen injectors, autoinjectors, MTX program

Vibex injectors: Includes epi-pen and undisclosed drug partnered with Teva

Vibex MTX and QST: Internal programs for injectable methotrexate and testosterone

Pen Injectors: Two undisclosed programs partnered with Teva

Gels: Transdermal technology, Elestrin, Nestragel, Libigel with BPAX

Anturol/Gelnique 3%: FDA-approved Overactive bladder gel licensed to Watson Pharma

Blog: Archive of all posts related to AIS/ATRS

Injectables: Vibex, HgH, Teva collaborations, Pen injectors, autoinjectors, MTX program

Vibex injectors: Includes epi-pen and undisclosed drug partnered with Teva

Vibex MTX and QST: Internal programs for injectable methotrexate and testosterone

Pen Injectors: Two undisclosed programs partnered with Teva

Gels: Transdermal technology, Elestrin, Nestragel, Libigel with BPAX

Anturol/Gelnique 3%: FDA-approved Overactive bladder gel licensed to Watson Pharma

Blog: Archive of all posts related to AIS/ATRS

Injector Device Division

- Injector device is one of the only ways to distinguish a biosimilar product. Click here to read a November 2010 interview with AIS CEO on the subject

- Click here to download a detailed review of the AIS technology

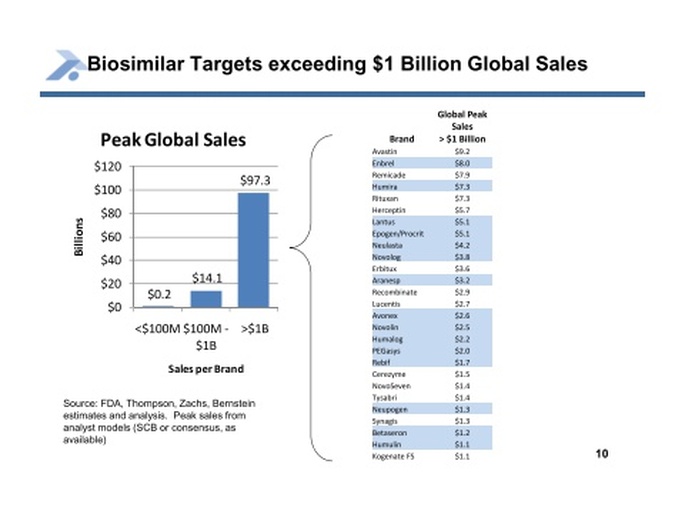

- Self-administered injectable (parenteral) drugs are a fast growth segment of drug industry- opportunity because of patent expirations and the shift towards more patient (vs healthcare provider) administration of drugs. 4/5/11 at Needham- patient demand is greatest driver of the parenteral market, more so than patent expirations or organic growth

- 2010 10k: "We estimate that self-administered injectable biologics represent well over half the market value of biologic products facing future competition from biosimilars."

- 3/15/11 at Roth: goal is to make injection at home as easy as taking a pill

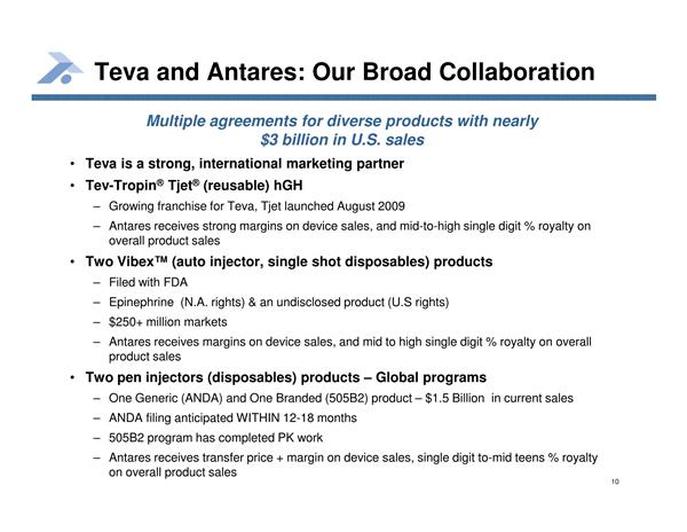

- 3/15/11 at Roth: TEVA is one of largest sellers of injectables on the planet, they see AIS as a "solutions provider" for drug/device combinations

- 3/15/11 at Roth: plan to offer exclusivity on a drug by drug basis

- $25B in current drugs are compatible with AIS devices

- Advantages of AIS devices include:

- Ease of use

- Rapid injection

- Promotes compliance

- Minimal sharps disposal

- High-quality subcutaneous injections

- Potential for multi-use systems

- Excellent reliability

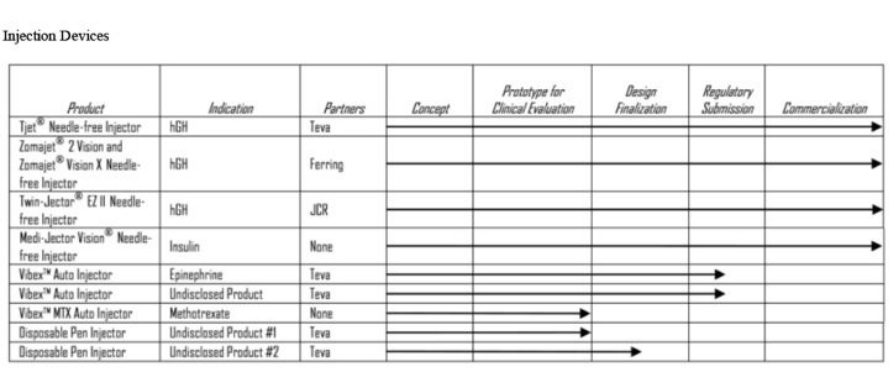

- Three different classes of injector products

- Vision Medi-jector: disposable needle-free multi-use injectors: spring pushes solution thru opening 1/2 diameter of 30 guage needle; device reusable for 3000 injections or ~2 years, needle free syringe insert holds about 1 week of drug...from 2010 10k

- Disposable Pen injectors: hold 7 or 30 days worth of product

- Vibex: disposable pressure-assisted autoinjector to pair with pre-filled syringes. Inject up to 1 mL in less than one second, pain scores much improved vs needle and syringe. 4/5/11 at Needham- complete injection in 0.5-1 sec, pts holds device on skin for 3 seconds. 2010 10k: designed for "acute medical needs, such as allergic reactions, migraine headaches, acute pain, emesis and other daily therapies, as well as potentially for the delivery of vaccines"

- November 2010- announced a new class of Vibex devices named "QS"-more compact device (click here for press release), can accommodate 1mL or larger volumes (common in self-injected products that are on the market or in development), and allows fast injection of highly viscous solutions

Injector product 1A: Vision human growth hormone

- This is AIS's first marketed injector product (2010 10k: sold in 30 countries) and generates 3 revenue streams

- Device sales

- Disposable parts sales for devices

- mid-high single digit royalties on product sales

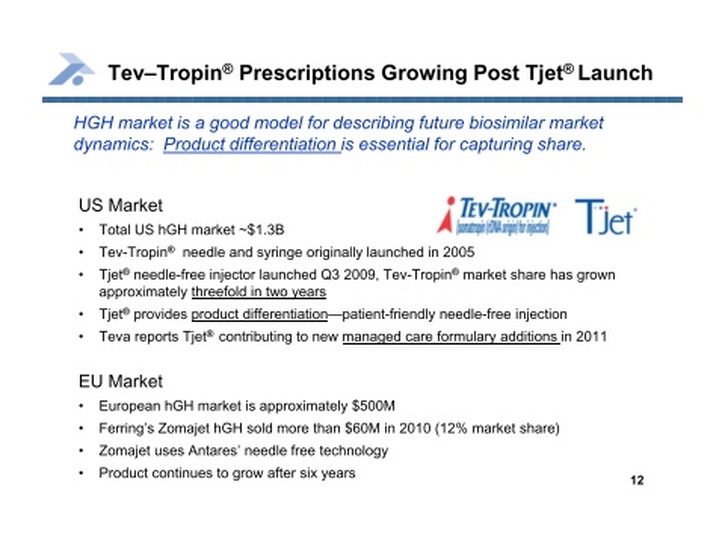

- Sold as "Zomacton" in Europe and Asia by Ferring with the Zomajet 2 Vision (4mg) and Zomajet Vision X (10mg), additional EU nation approvals on an ongoing basis (>$60m sales in 2010 with ~12% share of ~$500m market)

- Sold as "Tev-Tropin" with Tjet device in U.S. (filed sNDA 2008, approved 6/2009, launched August 2009) by Teva, and within one year the needle-free device/HgH product had doubled prescriptions compared to previous needle and syringe HgH product launched by Teva in 2005- this is achieved without AB-rated substitutable generic designation. 3/15/11 at Roth: Teva needle and syringe had 2% market share (largely a pediatric market).

- 2010 10k: worldwide HgH market is $2.8b. Biosimilar introduced in EU had <1% market share- many factors besides price and promotion are important- inc patient comfort and ease of use

- The US HgH market is >$1B total, so if Teva achieves similar penetration as Ferring, would sell $100-150m/year

- AIS makes money by selling the device and parts to Teva/Ferring and receives mid-high single-digit royalties from Teva (Ferring rate is lower)

- August 2010, 3/14/11 4q2010 CC: sales for both Teva and Ferring are ahead of forecasts.

- 5/9/11 CC: teva sales ahead of forecasts, driving higher royalties. Encouraging pt start data for 3/2011 and recent managed care wins. Ferring launching in new EU markets and increasing penetration in existing countries

- 3/14/11 4q2010 CC: expect continued sales growth, Ferring is increasing penetration internationally. 2010 Teva sales doubled in a year. Focus more on 3rd party payers as gain mkt share. Competitors are dropping prices to maintain share. Whole market dropped in Dec 2010, havent seen January IMS data yet

- 2q2010: received $0.5m sales milestone from Teva

- This product is also sold for use with insulin...very little is said about this by the company "The Company also continues to support existing customers of its reusable needle-free devices for the administration of insulin in the U.S. market through distributors" (1q2011 10q)

- Sold also as Twin-Jector EZ II by JCR in Japan