Navigate the Astex Pharmaceuticals ASTX Research Pages (was Supergen)

- Introduction (background, summary, links, valuation, financials, outlook, upcoming catalysts)

- Supergen-Astex merger (details on transformative transaction in 2011)

- DACOGEN (aka decitabine, marketed product for myelodysplastic syndrome MDS by Eisai and JNJ)

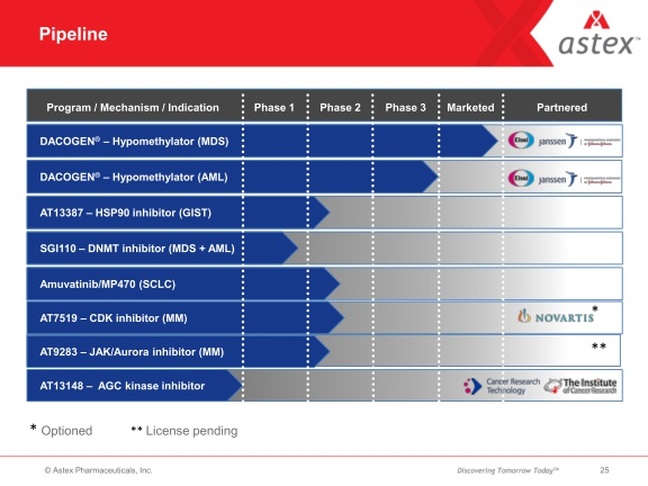

- AT13387 (HSP90 inhibitor for cancer)

- SGI-110 (follow-on to Dacogen for MDS and AML)

- Amuvatinib (aka MP470 in development for small-cell lung cancer SCLC)

- AT7519 (CDK inhibitor for multiple myeloma)

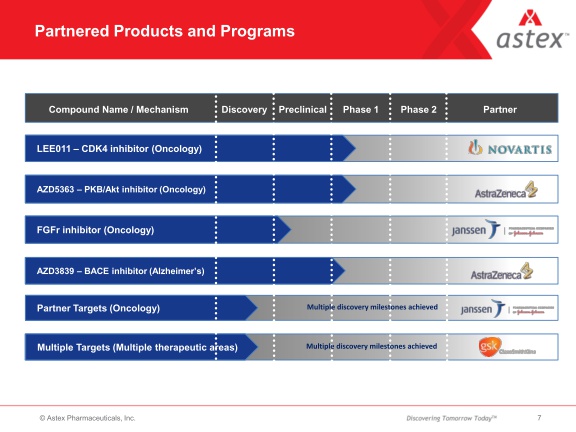

- Fragment-based Drug Discovery Collaborations (via Astex Ltd side of merger)

- Pipeline (other assets in development)

- Montigen (proposed spin-out transaction info and assets)

Astex Pharmaceuticals (ASTX)Website link: www.astx.com

Archive of blog posts and articles re ASTX: Click here for archived webcast notes from these presentations:

Roth Capital webcast 3/14/11 - click here for my notes 4/7/11 Astex merger announcement conference call 4/12/11 Joint Investor Day - Notes coming soon 4/2011 merger proxy - click here for my notes 5/17/11 Noble webcast - click here for my notes 6/2/11 Investor webcast - click here for my notes 8/2011 2q2011 CC - click here for my notes 9/12/11 Rodman and Renshaw - click for notes. 9/21/11 UBS webcast - click for my notes. 9/27/11 Jefferies webcast - click for my notes. 10/21/11 BioCentury webcast - click for my notes. 10/26/11 BIO Investor webcast - click for my notes. 11/16/11 Lazard webcast - click for my notes. 2/2012 BIO CEO conference - click for notes. 3/2012 Citi Healthcare conference - click for notes. 5/2012 ASCO preview and partner updates - click for blog. 5/2012 ASCO abstracts - click for part 1 - part 2. |

"Astex Pharmaceuticals™ is a leader in innovative drug discovery, development and commercialization, committed to the fight against cancer and other life-threatening diseases"

|

Links

- 2/2011 BIO CEO conference company snapshot.

- Click here for archive of all blog posts related to ASTX/SUPG.

- Click here for information on Monitgen spinout - first announced August 2011

- "Epigenetics Land Grab" - January 2012 BioCentury article on ASTX and competing programs.

Management

- James Manuso - Chief Executive Officer (CEO)

- Mohammed Azab - Chief Medical Officer (CMO)

- Michael Molkentin - Chief Financial Officer (CFO)

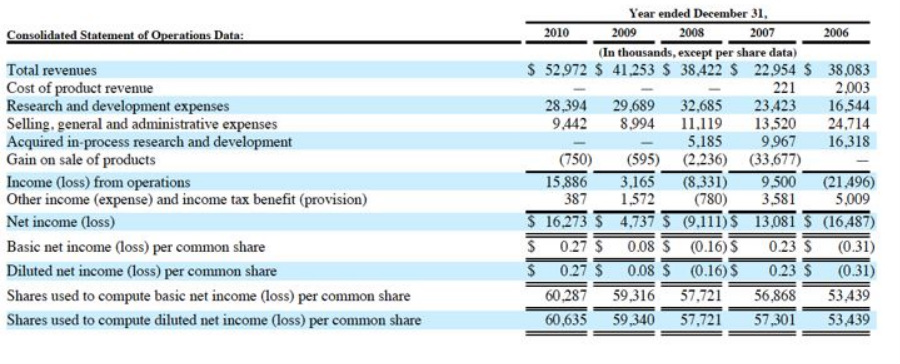

General Info and Outlook

- 1q2011 10q: now says Eisai Dacogen sNDA for elderly AML is planned for 2q2011

- 2010 10k: "In April 2006, we acquired Montigen, a privately-held oncology-focused drug discovery and development company headquartered in Salt Lake City, Utah. Montigen's assets included its research and development team, a proprietary drug discovery technology platform and optimization process known as CLIMB, and late-stage non-clinical compounds targeting Aurora-A Kinase [program is dead] and members of the Tyrosine Kinase receptor family [led to Amuvatinib (entering p2) and SGI1776 (dead)]. In addition to the consideration paid at the closing of the transaction [$9m in cash and $8.9m in shares], the merger agreement specified $22 million due to the former Montigen stockholders, payable in shares of our common stock, contingent upon achievement of specific regulatory milestones. In April 2007, we paid the first contingent milestone payment of $10 million, and in November 2008, we paid the second contingent milestone payment of $5.2 million, leaving one remaining future contingent regulatory milestone payment of $6.8 million that is payable in shares of our common stock upon notification by the FDA of the first filing of an NDA for a product containing as the active ingredient a compound identified using the CLIMB technology."

- 2010 10k: "As of December 31, 2010, we had 97 full-time employees, consisting of 74 employees in research and development and 23 employees in general and administrative functions."

- CMO left company 4/09, new one 7/09. No public market financing since 2004.

- Goal- partner after POC- will not advance anything to p3 w/o partner.

- Look at 20 targets/yr to yield on IND-ready compound.

- Formally owned and sold Nipent, sold rights in 2006 (for ~$21m total, including final payments of $0.7m in 2011 and 2012)

- A number of noncore assets at various stages that seeking solutions for.

- CA admin lease size reduced and extended 8/10 for 5 yrs, UT res lease exp 5/12. Own drug formulation lab in CA (note that ASTX hired Pharma Ventures in 9/2011 to sell this facility).

- 8/2010: losses or near breakeven for next several years.

- 12/31/10: own 2.38m shares of AVII worth $5.0m (AVI licensed a drug candidate Avicine to SUPG that was abandoned in 2003)

- $100m shelf filed 2/2009, still open, not used yet